FIVE STEPS TO HEAD OFF MORTGAGE STRESS

Are you ready to weather further interest rate increases? Follow this quick checklist

Are you ready to weather further interest rate increases? Follow this quick checklist

Two weeks after the RBA’s fourth consecutive rate rise with experts predicting a peak of 3.35 percent from its current 1.85 percent, and the reality of mortgage stress is starting to hit a little close to home for some. Here, Louisa Sanghera, founder of broking firm Zippy Financial and creator of the Mum CFOs Money Masterclass Course offers a quick checklist of ways to save money and minimise the mortgage dramas.

As a rule of thumb, everyone should be able to afford their mortgage repayments. Even when the interest rate sat at 1.69 percent last year, borrowers were being assessed for their capacity to service their mortgages with rates as 5.25 percent and higher. Banks like to have a buffer in place to ensure borrowers can meet their debt servicing rates.

Look at your mortgage now and consider if you can afford to repay it at a rate of 5.5 percent in the near future. If you can’t, visit your broker or bank to make plan. It may mean restructuring your mortgage over a longer term or moving to interest only on part or all of your mortgage for a while. Your bank or lender will have financial hardship policies in place to support you – the earlier you reach out, the more options you’ll have.

It only takes a few minutes to do a quick search online to compare prices. You’d be surprised by all the savings to be had from your everyday staples like petrol and groceries to big ticket items like fridges and appliances. Ask for a discount or at the very least price matching if you buy in store. Consumer advocacy groups like Choice and Canstar Blue are great for finding the best value for your money deals with hundreds of reviews to help you compare products.

Reassess all your utilities – electricity, gas, phone, internet, and insurance and see where you can cut back. For example, if your phone usage is a lot lower than what your plan accommodates, consider downgrading to something more affordable. Phone companies like Amaysim and Boost have great cheap deals on and use the same lines as Optus and Telstra.

If you haven’t switched providers recently, you could be unwittingly paying hundreds on their standard energy contracts. Do some research to see what’s out there then jump on the phone to your utilities provider to ask for a better rate. Make use of utilities comparison sites and ask them for their cheapest deal. Chances are you’ll come away with a healthy discount to stay with the same provider but if you choose to move providers don’t forget to check for any fees you’d have to pay for leaving.

Consolidate any debt you have to eliminate multiple loan fees and get rid of the high interest rates you’re paying on credit cards and loans. Rolling all your debts into one loan means you only need to make one regular repayment at the same interest rate. This means you could potentially pay off your loans and your mortgage faster.

You can add these debts onto your mortgage split in a separate short-term loan to repay at your current mortgage interest rates. Also known as a ‘top up’, a home loan increase allows you to access the equity in your home by either increasing the balance on your loan or creating a separate loan that’s linked to the same property. Consolidating debt has its advantages but you must weigh out its benefits over the long term as it’s likely to result in more interest charged over time. Take a good look at your overall financial position and total costs to work out if the lower interest rate offered by home loans will work out well for you in the long run.

Managing discretionary spending is like flexing a muscle. The more you do it, the more it becomes second nature to you. Australians spend a lot on takeaways and food deliveries spending an average of $40 a week on meal delivery services. Other expenses like taxi rides, entertainment, alcohol, and online shopping tend to add up as well. You can trim the fat by opting to meal plan and eat at home, substitute going out for a fun movie night in and deleting all those shopping apps.

Save yourself from impulse purchases by always making a list and sit on it for a few days. Then you’ll know if you really need it. Don’t browse on shopping sites mindlessly – find other ways to entertain yourself. Things like parks, museums and cultural events are often low or no cost. Not only will your wallet thank you in the end, you might end up being healthier too!

Millions of workers will see the impact of Stage 3 tax cuts in their next pay packet

Stage 3 tax cuts will commence on Monday, providing 13.6 million workers with tax savings that they will see in their first pay packets of FY25. The average Australian wage earner on $74,500 per year will receive a $1,540 tax saving over the new financial year. The Superannuation Guarantee is also going up from 11 percent to 11.5 percent from Monday, providing the same worker with a $372 bump per annum to the superannuation payments they receive from their employer.

The Albanese Government amended the Stage 3 tax cuts in January to give every taxpayer a tax cut rather than only those on higher incomes. Many economists have argued the tax cuts will add to inflation, which is proving to be remarkably sticky. Yesterday, the Australian Bureau of Statistics released the May inflation figures showing a 4 percent annual increase in inflation, up from 3.6 percent in April.

The Federal Government decided to amend the legislated tax cuts in January to help more Australians with rising cost of living pressures. Official advice from the Federal Treasury said the amendments were “broadly revenue neutral” because they would cost almost the same amount as the original Stage 3 plan, which had already been factored into inflation forecasts. The amendments reduced the tax break for earners at the top end to enable tax relief for everyone. A Treasury document said the changes “will not add to inflationary pressures and will support labour supply”.

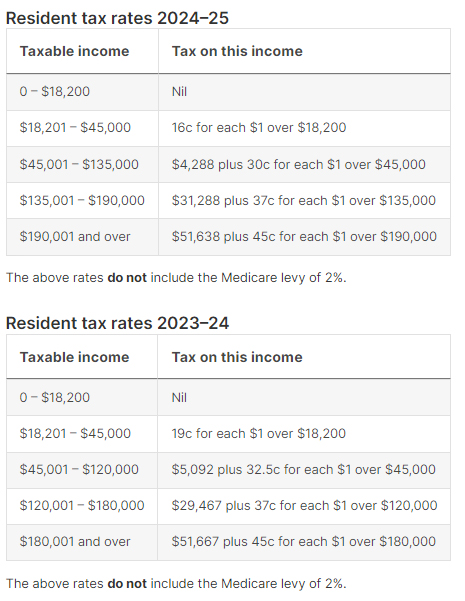

The tables below outline how the tax rates and tax brackets will change from Monday.

At a press conference after the Reserve Bank announced interest rates would remain on hold last week, Governor Michele Bullock said she expects some people would use their tax cuts to cover everyday expenses while others would save it.

“What we do observe in the data is that people who have mortgages – on average, not all – but people on average who have mortgages tend to try and put more into their offset accounts and their redraw facilities because they’re paying quite a high interest rate now on their mortgage and so they want to offset it,” she said.

A Westpac survey found Australians planned to save up to 80 cents for every $1 of tax savings.

“The results suggest consumers will use tax relief as an opportunity to repair their finances and rebuild saving buffers rather than spend,” said senior Westpac economist Matthew Hassan.

If taxpayers followed through on this plan, Mr Hassan said only $4.7 billion of the $23.3 billion in tax relief would be spent, equating to a spending boost of 35 basis points.