PROPERTY VERSUS SHARES: WHICH IS A BETTER INVESTMENT IN 2024?

With the real estate market gaining traction once again, which is your best option this year?

With the real estate market gaining traction once again, which is your best option this year?

For those on the hunt to find the perfect investment opportunity in 2024, two of the main sources of potential investment income to consider are shares, and the property market. The latter, currently, is gaining momentum again in Australia, coupled with stabilising interest rates, and inflation on a downward trend compared to this time last year.

On the other hand, if entering the property market is out of the question right now and you’d rather start small, investing in shares is a great alternative to consider. Naturally, there are always going to be dangers and risks associated with any type of investment, be it property or shares, but with some research and guidance, you’ll be better suited to make a decision.

“One thing all investors should do in the beginning is understand the asset class they want to invest in. If your personal interest is in building a property portfolio, then researching property investing and understanding the ins and outs is key,” David Pelligra, director & mortgage broker at Wealth Point Lending, says.

“The same goes for shares. If you are someone who enjoys the nuances of the share market and the inner workings of a publicly listed company, then again, researching that particular part of the market is important. My biggest piece of advice when investing is to speak with professionals that understand the market you are wanting to invest into.”

So, in 2024, which is your best option for starting your investing journey? What are the pros and cons of each? These are the questions you must ask before investing your money in either sector.

The idea of investing in shares as a means for potentially earning high returns has long enticed those looking to increase their capital growth over a long period of time. Shares also present the opportunity for ownership in companies with shareholders enjoying particular voting rights and dividend potential. Those who invest in shares often have a degree of flexibility and control, which is a comfort when investing large sums of money. For example, should you wish to access your funds at any point in time, often you can do so instantaneously. This cannot be done with property.

“Shares are a liquid asset, meaning you can sell parts or all of your portfolio, allowing for quick access to cash,” Pelligra says.

When investing in shares, individuals — novice or otherwise — should consider adding blue chip shares to their portfolio. These are shares issued by a large corporation, often one of notoriety, with an excellent reputation and experience in market capitalisation. Blue chip shares are often safe and risk-adverse, however any financial gain is usually in the long-term.

As Warren Buffett once said, “the first rule of an investment is don’t lose (money). And the second rule of an investment is don’t forget the first rule. And that’s all the rules there are.”

Despite their advantages, it’s essential to remember that investing in shares also carries with it risks, including the potential for the loss of capital. Price volatility is also another important factor to consider — where shares prices rise and fall rapidly over the space of days or months. Those who invest in high risk shares — although seeking higher returns in a short amount of time — have to be prepared that they could lose a large sum of money depending on which way the market swings.

Naturally, when endeavouring to invest in shares, it’s important to conduct thorough research. This includes seeking advice from financial professionals before making large investment decisions.

Somewhat a no-brainer, investing in property offers a number of benefits, from capital growth (should the property rise in value over time), through to reduced volatility (historically, property prices only go up). If you’re planning on owning a property as an investment—and plan on leasing it—you can generate continual cash flow to cover your property expenses. Unlike shares, investing in property is a physical endeavour, in that it’s something people can see and touch, which is always favourable.

For those that are looking long-term and don’t necessarily need the instant cash flow (yield) renting a property can provide, investing in property for capital gain is also a great way to increase your finances considerably. Depending on where you buy, residential properties have the potential to rise in value in a relatively short period of time, and as a result, can offer owners a significant gain should they look to divest at the right time.

“Investing comes with an inherent risk, but the key is to look at past performance. Property, for example, has consistently performed in Australia for the last 30 years, so you could feel quite safe if you were investing,” says Pelligra.

“Property is also a physical asset that you can either live in, or earn an income from if you are to rent it out.”

There are a number of potential pitfalls that come with investing in property. No one can predict where the property market is going to go, whether interest rates will rise or fall, and if you plan on renting your property, whether your tenants do the right thing in the way of upkeep, making regular payments, and so forth. Properties can also have additional costs attached, such as maintenance, repairs and upgrades, as well as insurance. For those looking to gain capital on an investment property they don’t live in, you also need to consider the capital gains tax, which naturally reduces savings and investment incentives.

Of course, there are ways of mitigating the risks of investing in property by doing thorough research, and speaking to the professionals who can assist you on your journey.

—

All commentary made is considered general advice. It is recommended to seek financial advice from a professional before making decisions associated with investing.

Article originally published on Kanebridge News Australia

Millions of workers will see the impact of Stage 3 tax cuts in their next pay packet

Stage 3 tax cuts will commence on Monday, providing 13.6 million workers with tax savings that they will see in their first pay packets of FY25. The average Australian wage earner on $74,500 per year will receive a $1,540 tax saving over the new financial year. The Superannuation Guarantee is also going up from 11 percent to 11.5 percent from Monday, providing the same worker with a $372 bump per annum to the superannuation payments they receive from their employer.

The Albanese Government amended the Stage 3 tax cuts in January to give every taxpayer a tax cut rather than only those on higher incomes. Many economists have argued the tax cuts will add to inflation, which is proving to be remarkably sticky. Yesterday, the Australian Bureau of Statistics released the May inflation figures showing a 4 percent annual increase in inflation, up from 3.6 percent in April.

The Federal Government decided to amend the legislated tax cuts in January to help more Australians with rising cost of living pressures. Official advice from the Federal Treasury said the amendments were “broadly revenue neutral” because they would cost almost the same amount as the original Stage 3 plan, which had already been factored into inflation forecasts. The amendments reduced the tax break for earners at the top end to enable tax relief for everyone. A Treasury document said the changes “will not add to inflationary pressures and will support labour supply”.

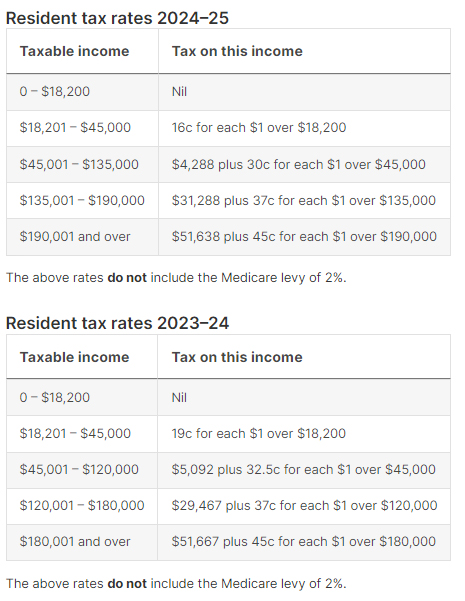

The tables below outline how the tax rates and tax brackets will change from Monday.

At a press conference after the Reserve Bank announced interest rates would remain on hold last week, Governor Michele Bullock said she expects some people would use their tax cuts to cover everyday expenses while others would save it.

“What we do observe in the data is that people who have mortgages – on average, not all – but people on average who have mortgages tend to try and put more into their offset accounts and their redraw facilities because they’re paying quite a high interest rate now on their mortgage and so they want to offset it,” she said.

A Westpac survey found Australians planned to save up to 80 cents for every $1 of tax savings.

“The results suggest consumers will use tax relief as an opportunity to repair their finances and rebuild saving buffers rather than spend,” said senior Westpac economist Matthew Hassan.

If taxpayers followed through on this plan, Mr Hassan said only $4.7 billion of the $23.3 billion in tax relief would be spent, equating to a spending boost of 35 basis points.